Tax the super rich to combat social inequality

The tax reform of Economy Minister Paulo Guedes benefits bankers and leaves the structure that penalizes workers unchanged

Publicado em: 31 de agosto de 2020

Centro de Serviços de Sorocaba

Centro de Serviços de Sorocaba

This article is an English translation of “Taxar os super-ricos para combater a desigualdade social”, Esquerda Online (EOL), 01/08/2020. Translation: Bobby Sparks

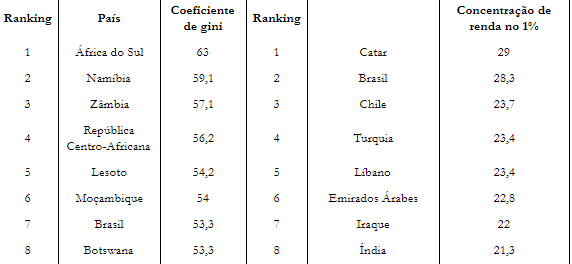

No matter which yardstick is used to measure social inequality, Brazil always figures among the most unequal nations in the world. According to the United Nations Development Program (UNDP), in 2018 Brazil was the country with the seventh highest Gini coefficient, a figure which measures levels of inequality. If we look at the concentration of wealth among the richest 1%, in Brazil 28.3% of the country’s wealth is concentrated within this portion of the population. Here Brazil is second only to Qatar, an absolutist country with hereditary power.

Table 1 – Ranking of countries with the highest Gini coefficient and the highest concentration of income of the richest 1%

Source: UNDP

We know that the leading generator of inequality is the fact that some receive (generally low) wages for their work and others receive (generally high) profits and income from the work of others. But this does not explain all inequality.

There are other determinants. In Brazil, the primary reason is the four long centuries of the slavery of black people, and the legacy of structural racism which still persists for them today. To understand this reality, it is enough to note that black workers earn less than half of what a white man earns. A black woman works twice as long as a white man and still receives less than half of what he earns.

There are also other determinants, such as patrimonial inheritance, machismo (male chauvinism), LGBTphobia, etc., that are intertwined in very complex social issues.

But in this editorial, we want to talk about something in particular, about how the State intensifies these inequalities with its unjust taxation system and how the tax reform that we defend seeks to combat this.

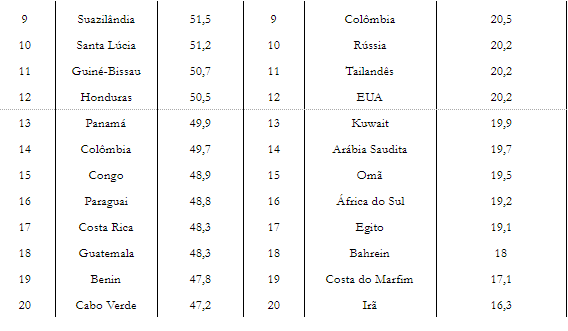

In Brazil, the more money you have, the less tax you pay. According to a survey published by the Institute of Applied Economic Research (IPEA), the country’s richest 10% pay a total of 21% tax on their income, while the poorest 10% pay the equivalent of 32% tax.

Chart 1 – Tax paid compared to income

The 1st decile represents the poorest 10% and the 10th decile represents the richest 10%

Source: IPEA, “Equidade fiscal no Brasil: impactos distributivos da tributação e do gasto social”. Comunicado do Ipea nº 92, maio de 2011. (Taxation equity in Brazil: distributive impacts of taxation and social spending. IPEA Notice No. 92, May 2011).

This Robin Hood in reverse occurs precisely because the Brazilian tax structure is regressive. Even though Brazil has a tax burden below the OECD average – 32.3% of GDP compared to the OECD average of 34.2% – the country charges taxes in an unfair manner. First, Brazil has an excessive reliance on consumption taxes. We pay taxes that are built in to prices whenever we buy a carton of milk or a computer, get a haircut or catch a bus. According to Federal Revenue, Brazil has a tax burden of about 14.3% on goods and consumption, which puts it in fourth place among the OECD countries that charge the most tax on goods and services, 3.2 percentage points above the average.

On the other hand, Brazil is the country with the sixth lowest taxes on income, profit and capital gains among the 34 countries in the survey mentioned above. Brazil is also far below the average when it comes to the tax burden on property. In short, Brazil taxes consumption a lot and only taxes income and wealth a little.

The first problem that stems from is that when you tax consumption you do not differentiate the income from the individual. The same tax on beans is charged for the poor and the rich. The second is that the richer a person is, the more he or she saves, which prevents this portion of income from being properly taxed. The third, also regarding income tax, is that in Brazil no tax is charged on dividends (profits appropriated by the private individual), which further increases the gap between employers and employees, the bourgeoisie and workers. Fourth, wealth is not taxed very much at all. Wealth, which is different from income, is things like real estate, company stocks and other types of assets. They are held by only a few people, as the lower the income the less chance there is of accumulating real estate or businesses.

For a progressive tax reform: higher taxes for the super rich and lower taxes for workers and the poor

For big business owners, Paulo Guedes and parties like the DEM, MDB, PP and PSDB*, the problem of taxation in Brazil is something else: one of the system’s “complexity”, the need to appease specific sectors and the poor distribution among them. For them, the problem is that Brazil is the country where big businesspeople spend more time collecting taxes, or that services pay less tax than industry does.

Precisely because of this, the Bolsonaro government’s tax reform project is limited to proposals like the merger of taxes such as PIS and COFINS (taxes that finance unemployment and social security benefits), the creation of a single value added tax that replaces all other taxes, and of even decoupling it from financing items such as Social Security. The reform proposed by Paulo Guedes and now under discussion in Congress preserves the perverse and unfair tax structure that benefits bankers, big businesspeople and billionaires.

No tax reform project from the right-wing proposes to touch on social injustice and fight one of the most horrendous privileges generated by the Brazilian State, that of charging more tax the poorer you are.

That is why we must fight for progressive tax reform that is based on solidarity. Those with higher incomes must be taxed more, with increases in income tax rates for the richest and more exemptions for those at the base of the pyramid. There must be a return to income taxes on dividends. Regulatory taxation on large fortunes and increased taxes on inheritance are urgently needed. And finally, the creation of an emergency tax on the banks for financing the fight against the pandemic is required.

This reform must serve as a mix of raising taxes on the rich to finance public services, which is fundamental to reducing inequality and reducing the tax burden on the working class and the poor. This will help to increase consumption among people with lower incomes and build a State that serves the vast majority of Brazilians, not the privileged 1% of society. Such a State cannot be one which endorses inequality in a country where 42 billionaires have increased their wealth by US$34 billion amid the worst pandemic and biggest economic crisis in history.

* Four of Brazil’s center-right bourgeois parties. DEM: Democratas (Democrats); MDB: Movimento Democrático Brasileiro (Brazilian Democratic Movement); PP: Partido Progressista (Progressive Party); PSDB: Partido da Social Democracia Brasileira (Brazilian Social Democracy Party).

Top 5 da semana

colunistas

A Federação do PSOL com o PT seria um erro

colunistas

Uma crítica marxista ao pensamento decolonial e a Nego Bispo

movimento

Por um Estatuto da Igualdade Racial e uma Política de Cotas que contemple os Povos Indígenas em toda sua diversidade!

movimento

Não “acorregeia” senão “apioreia”

meio-ambiente